Yesterday’s US Consumer Price report for April was just plain ugly, and markets reacted accordingly. The YoY pace slowed to 8.3% from 8.5% in March but was above expectations for a decline to 8.1%. Core CPI came in hotter, at a 0.6% MoM increase versus expectations for an increase of just 0.4%.

In the past, bad economic news cheered equity markets in hopes that the Federal Reserve or the government would offer stimulus. Similarly, yesterday’s hotter-than-expected CPI gave reason to fear a more hawkish Fed, which increases the perceived probability that the economy will be pushed into a recession and that push long-term yields lower. That is why the Treasury yield curve is flattening with the expectation of more aggressive tightening. That is also why the spike in the yield on the 10-year in May has been completely wiped out over the past few trading days; the 10-year acts as a proxy for GDP growth expectations.

Looking at the CPI numbers and comparing them to the equity markets, we find that the market is expecting that higher prices will not lead to improved margins.

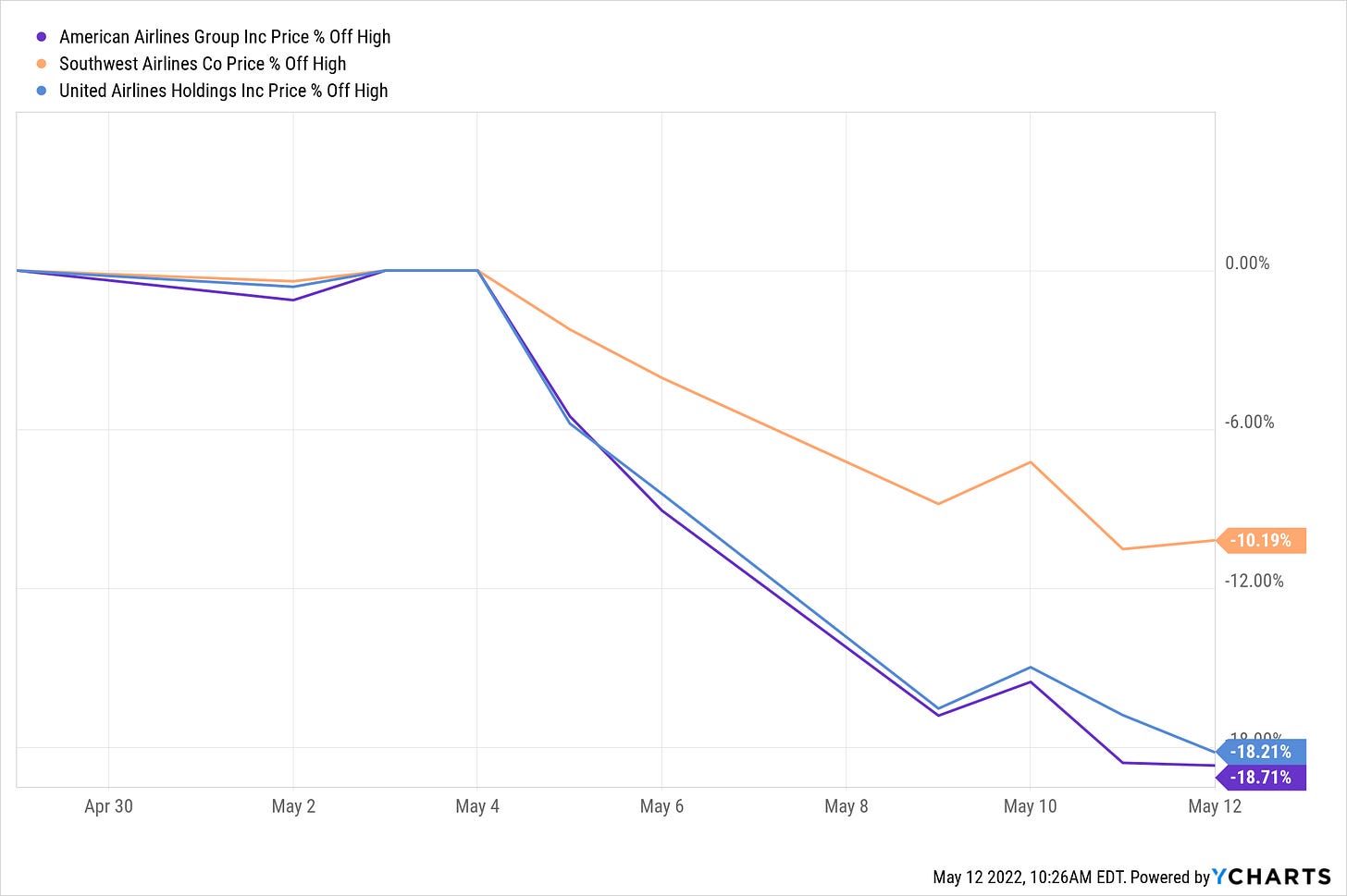

Airline fares accounted for 20% of the total increase in core CPI for the month with their 18.6% MoM increase thanks to the double-whammy of enormous jet fuel price increases and the enthusiastic return to travel. If we look at the NYSE Arca Airline Index (XAL), it is down over 45% from its March 2021 high and down nearly 30% from its 2022 high. Since the beginning of May, American Airlines Group (AAL) and United Airlines Holdings (UAL) are down around 16%, and Southwest (LUV) is down more than 8%. That is saying that these price increases are not likely to translate into sustained higher margins.

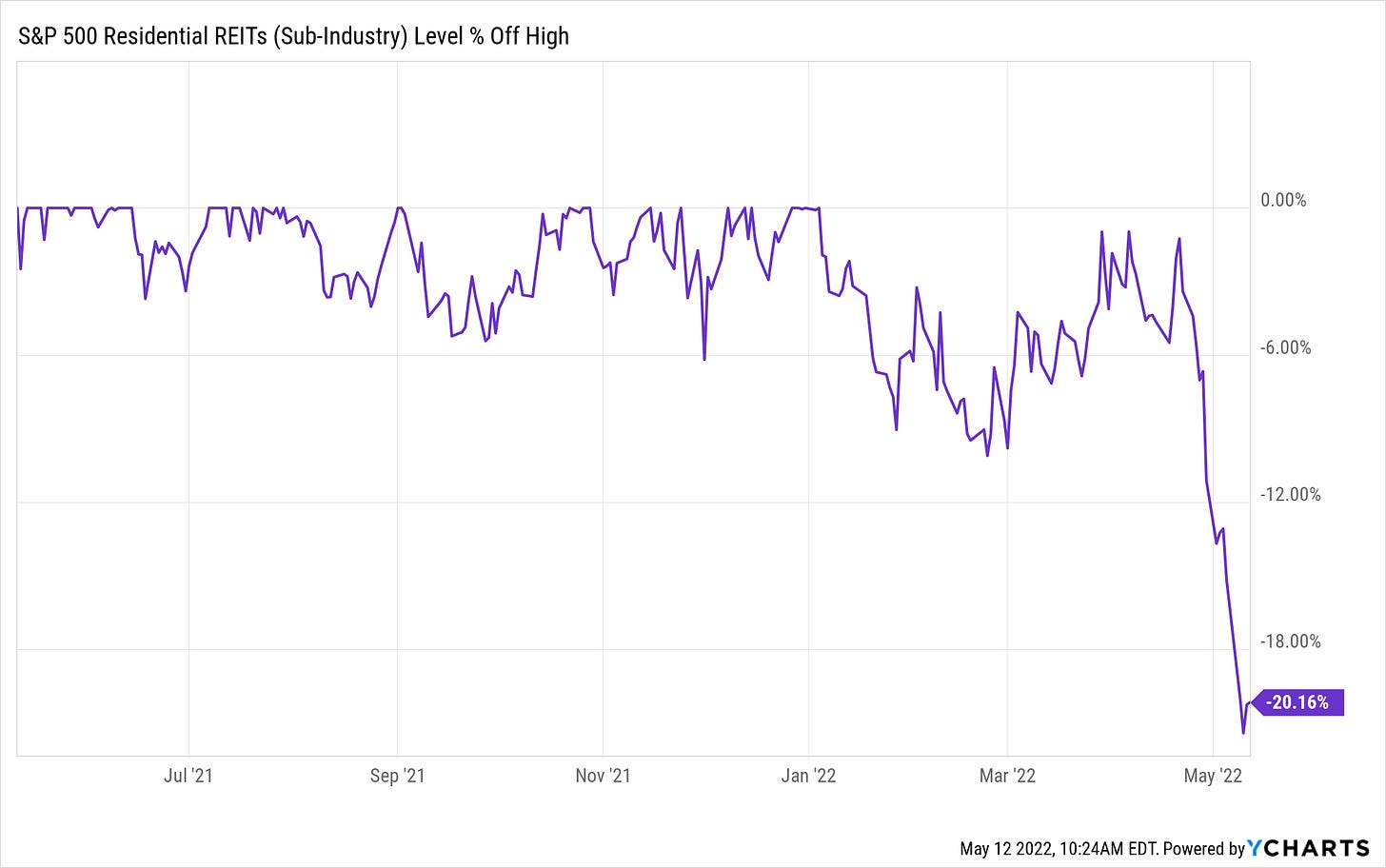

While rent CPI is running at around 6% annualized, the S&P 500 Residential REITs is down 20% from its high.

CPI for new cars was up 14% in April on an annualized basis and up 12.3% over the past twelve months on an annualized basis, yet the S&P 500 Automobile & Components index is down over 40% from its November 2021 high.

The most concerning aspect to me was the increase in the service sector, with the core service index spiking 0.7%, the most significant 1-month increase since August 1990, but there were some positive signs of prices rolling over.

Durable goods were basically unchanged following a 0.9% decline in March, which is what we would expect to see given that this segment tends to be more sensitive to interest rates and thus will respond to the Fed’s hikes first.

What has me most concerned is the lack of wage growth.

Real average weekly earnings contracted 0.02% in April, the seventh consecutive decline. Over the seven-month period, real work-based wages are down at a 4.6% annualized pace and down 3.4% on a YoY basis. To put that in context, the worst this ever got during the Great Financial Crisis was -3.2% in July 2008. That means that around 80% of the country is already in an income recession, which means that spending is heading for a fall as well.