Yesterday’s Federal Reserve Chair Powell managed to add over $1 trillion in market cap to the S&P 500 as the index ended the day up 3.0%, its best 1-day performance since May 18, 2020.

Why did the market respond with such glee when the Fed announced both a rate hike and balance sheet reduction that was in line with expectations and would normally have been considered hawkish?

There are three reasons by my estimation.

First, the Fed’s statement acknowledged downside macro risks from Russia’s invasion of Ukraine, “the implications for the US are highly uncertain,” and “invasion and related events …. are likely to weigh on economic activity.” That’s code for we may stop tightening sooner than expected because we are worried about the economy. He also admitted that “…I’ll say I do expect that this will be very challenging, it’s not going to be easy, and it may well depend, of course, on events that are not under our control.” They are worried and watching.

Second, during the press conference Q&A, Powell took the risk of a 75 basis point hike off the table. By the end of the conference, stocks were up 2%.

A third possible driver, although a more minor one, was Powell’s comments on inflation, “We’ve seen some evidence that the core PCE inflation is perhaps either reaching a peak or flattening.”

With that said, let’s look at the carnage in the seriously oversold bond market. This is some fairly epic stuff.

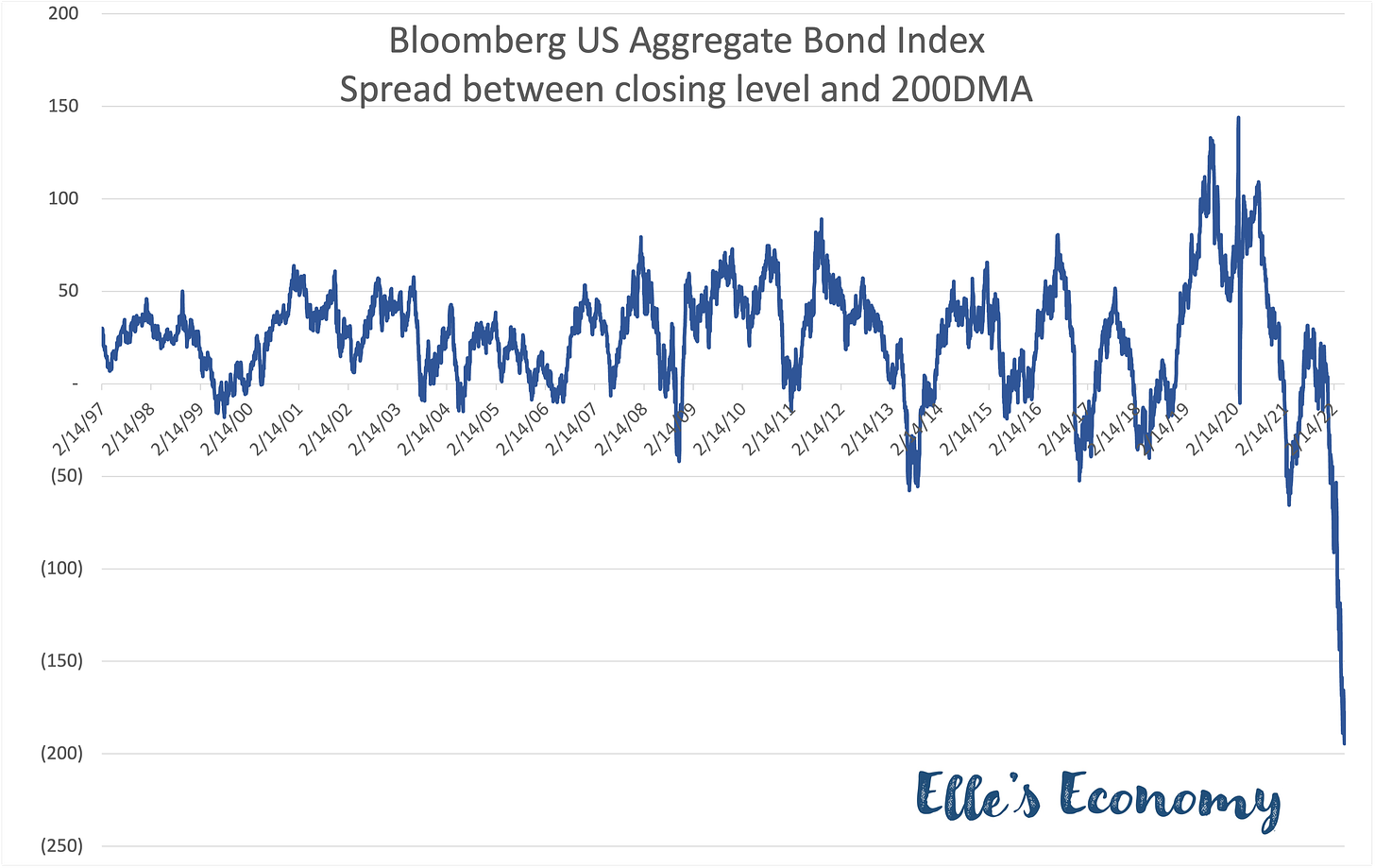

The spread between the closing level and the 200-day moving average of the Bloomberg US Aggregate Bond Index (a good benchmark for US investment-grade bonds) has reached a record low of incredible proportions on an absolute level.

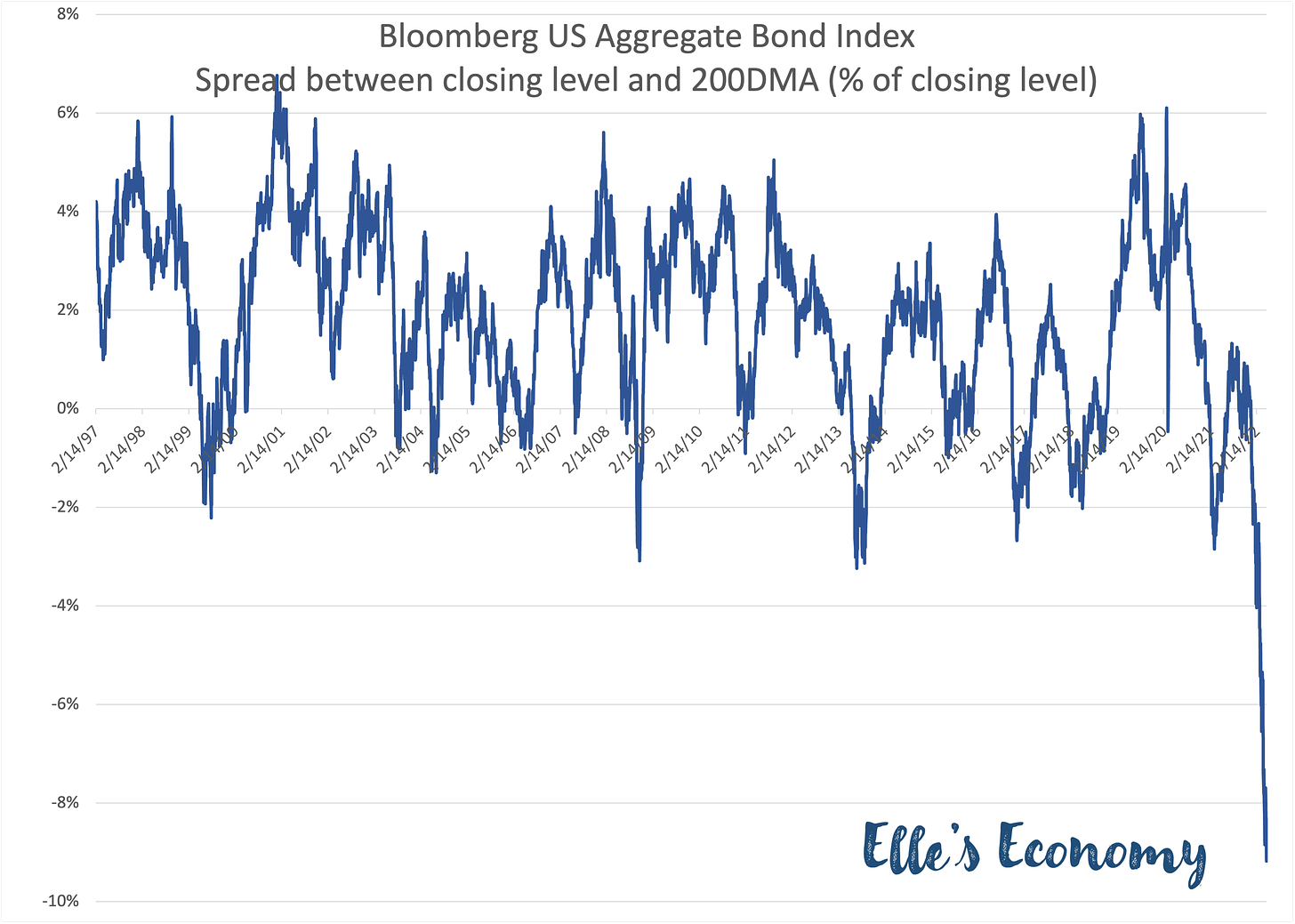

It has also reached a new record on a relative basis, with the spread as a percent of the closing level.

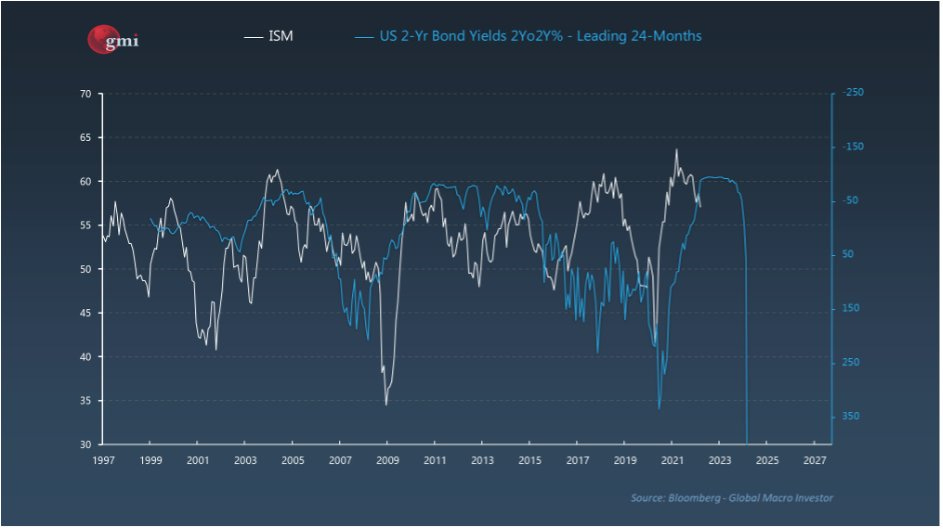

The index this deeply into oversold conditions shows just how dramatic the tightening has been in financial conditions over the past six months. Hat tip to Raoul Pal of Real Vision @RaoulGMI for this chart that shows just how dramatic the tightening has been, even before the Fed gets going. As Raoul puts it, “The rate of change of yields is a forward indicator for growth, which I’ve used for many years. This is the biggest tightening of financial conditions ever.”

If history is any teacher, beware of the upcoming fall in the ISM and, with it, an economy that moves deeper into contraction.