Inflation or Corporate Profits?

C Suite moaning about inflation pressures while profit margins spike

First, yesterday was quite the bounce off of seriously oversold conditions:

Nearly 90% of stocks gained on the day.

Every sector closed in the green.

Growth outperformed.

US Dollar Index DXY hit a two-decade high after closing higher in 19 of the past 21 trading sessions.

This morning the party was over, with all the indices deeply in the red by mid-afternoon as April 2022 is turning out to be the worst month for stocks since March 2020.

Now to the topic of the day.

We keep hearing moans and groans from the C suite during earnings calls about the pain from inflation, and anyone who has filled up their car or bought groceries would agree that prices are a lot higher these days.

I hate the term “inflation” because it gets tossed around as if it means just one thing and the same thing to everyone. Today, it is used as a cover to raise prices.

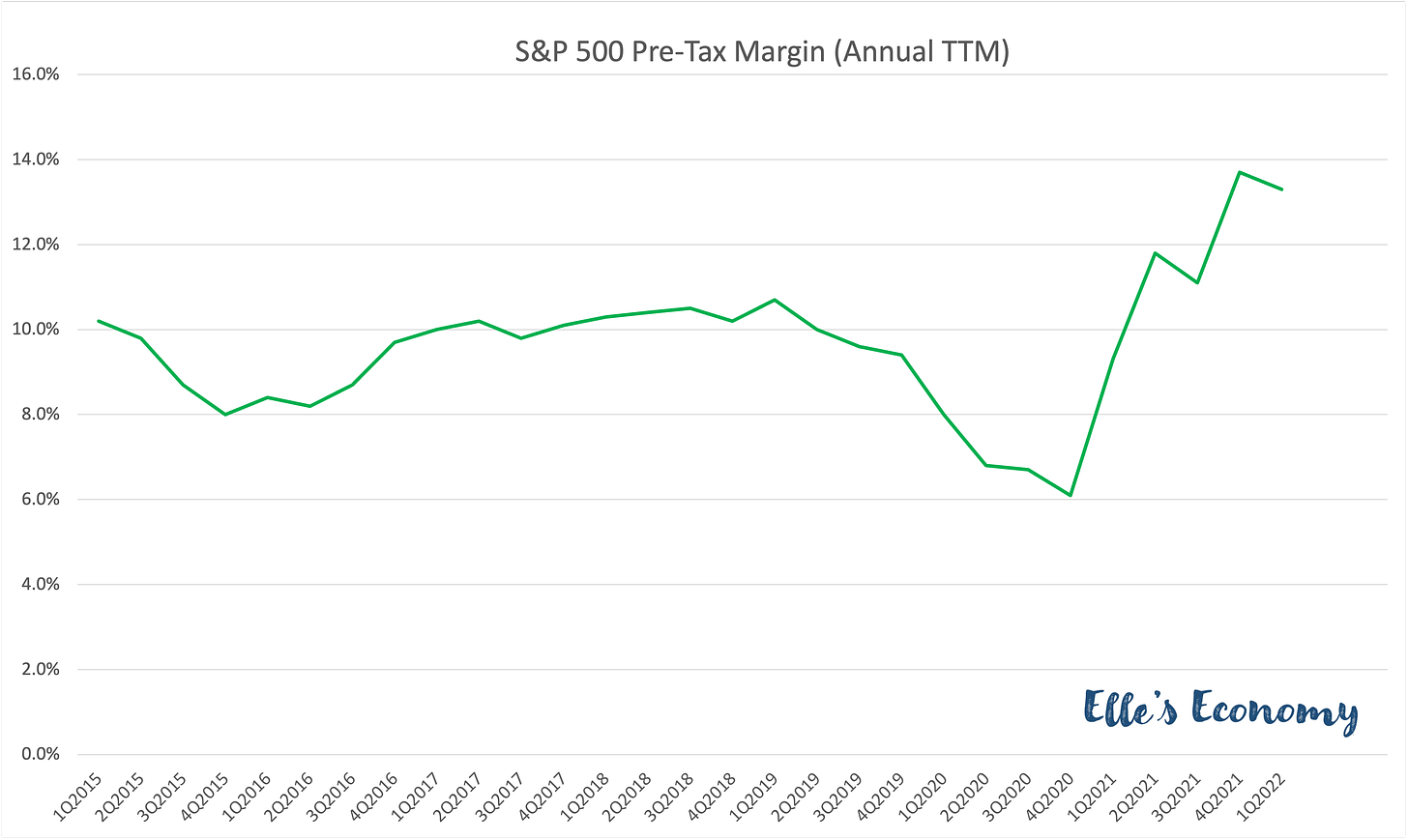

Pre-tax net profit margins for S&P 500 companies expanded to 13.7% (annualized TTM) in Q4 2021 and to an estimated 13.3% in Q1 2022. The pre-pandemic average for 2015 to the end of 2019 was 9.6%. These companies have effectively pushed onto the consumer four years’ worth of price hikes in just one year.

The current trend is way above the norm when it comes to passing on higher input costs to the consumer. Data from the Economic Policy Institute from 1979 to 2019 shows that companies were able to place an 11% premium on top of their cost increases, with labor accounting for around 60% of those increased costs.

Despite all the moaning from hiring managers, the higher labor costs today account for less than 10% of the price hikes (versus the 60% historical norm), while 50% comes from expanding profit margins - not the 11% previously seen.

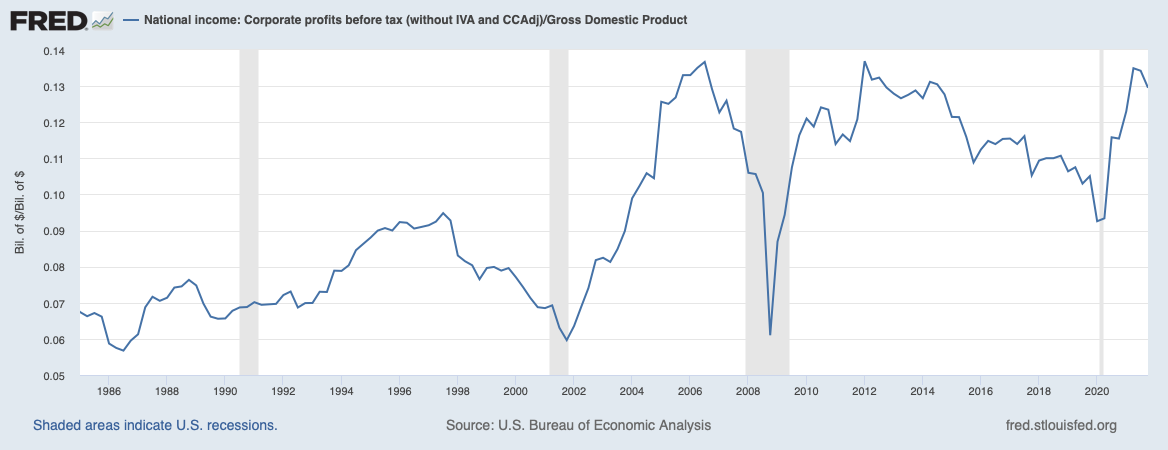

Data from the Federal Reserve shows that corporate profits as a percent of GDP are at peak levels that don’t last and already look to be rolling over.

The bottom line is that margins will decline when consumers decide enough is enough. With P/E multiples already falling, a decline in E will put further downward pressure on stock prices.