It's Growth, Not Inflation Driving the Markets

Those infuriating prices at the grocery checkout line are lagging indicators

Good morning and welcome to a Friday chart-a-palooza to kick off the weekend!

The recent market moves are indicating that investors are driven less by inflation fears and more by a growing concern that the economy is headed into a recession.

The Citigroup Economic Surprise Index (CESI) has continued to fall, dropping down to levels seen just a few times over the past 15 years. This index measures economic data coming in relative to expectations. When the index rises, the macro data has been better than expected and when it falls, the data has been worse than expected.

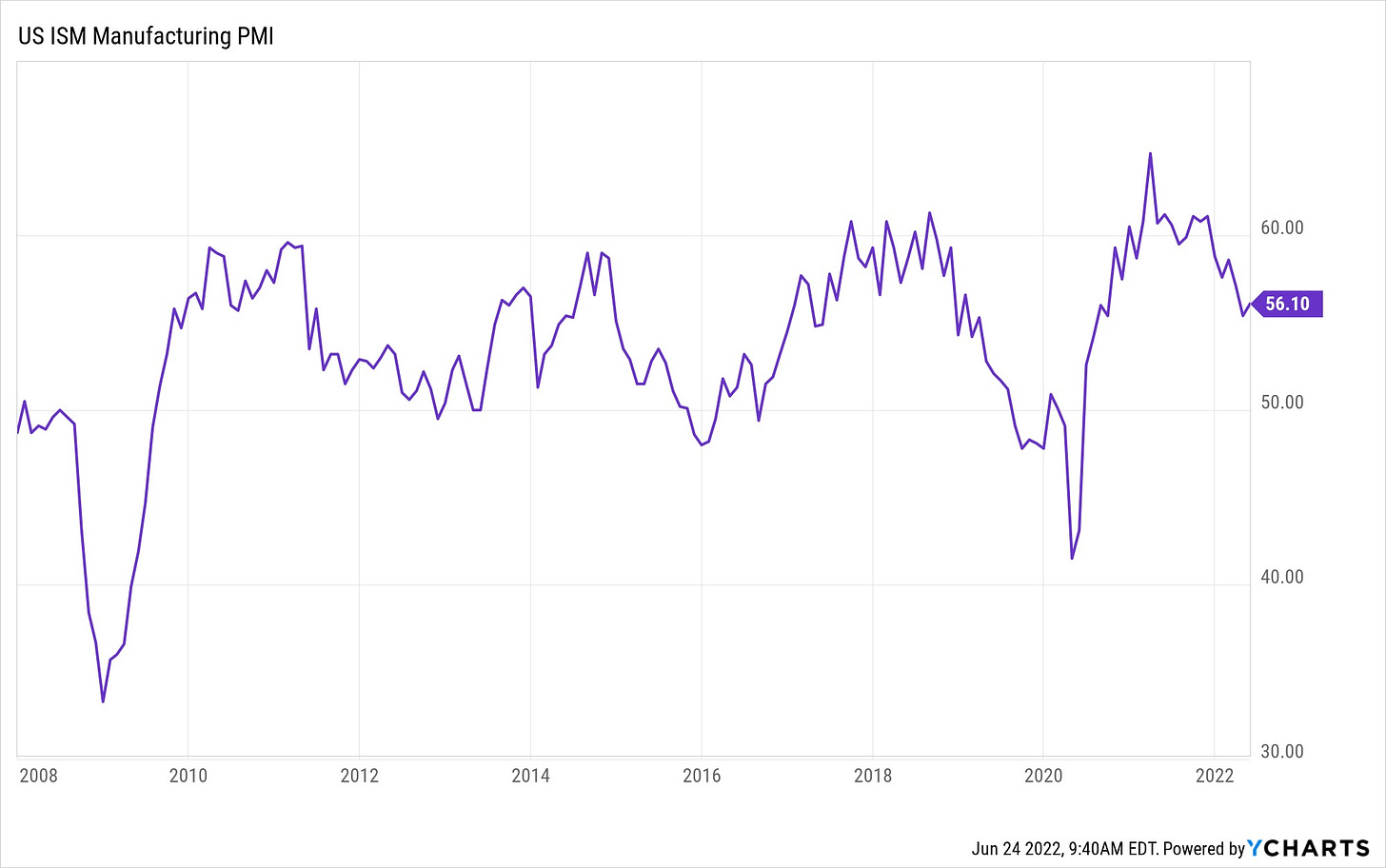

The Institute of Supply Management (ISM) Purchasing Manager Index (PMI) tends to follow the CESI with some lag, which leads me to believe that we will be seeing a sharp decline in the PMI in the coming months. Yeah, yeah, I know - super exciting stuff to comment on right?

Here’s the thing, going back to the early 1970s, every time the ISM dropped to 50 the Federal Reserve has paused rate hikes or cut. I would not be surprised to see the ISM PMI slide below 50 by the fall and then we’ll see just how committed Powell is to hiking rates.

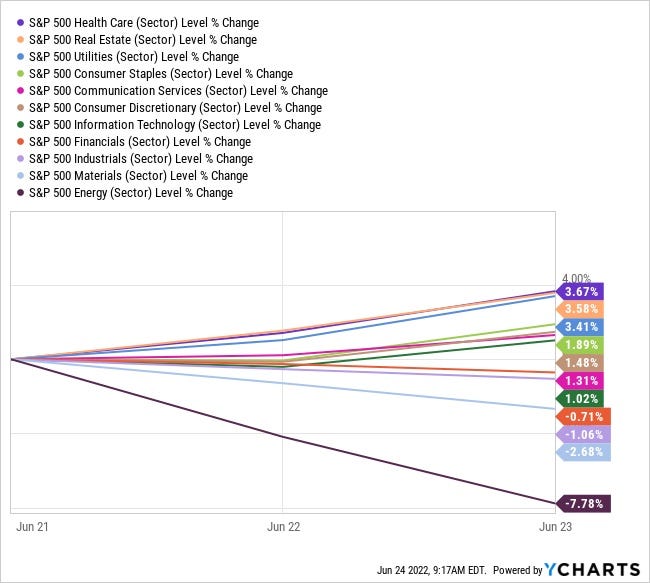

The market has started pricing in a meaningful economic slowdown. Over the past few days, the defensive sectors have materially outperformed the more cyclical sectors.

Accelerating an evolving trend.

The thing about “inflation” when we are talking about the prices we see in the grocery store or when buying that new suitcase (I just picked up this beauty after my old one was mangled by a hotel porter in London and I have to say I have an unhealthy love for it.) is that they tend to be very lagged with respect to where we are in the economic cycle.

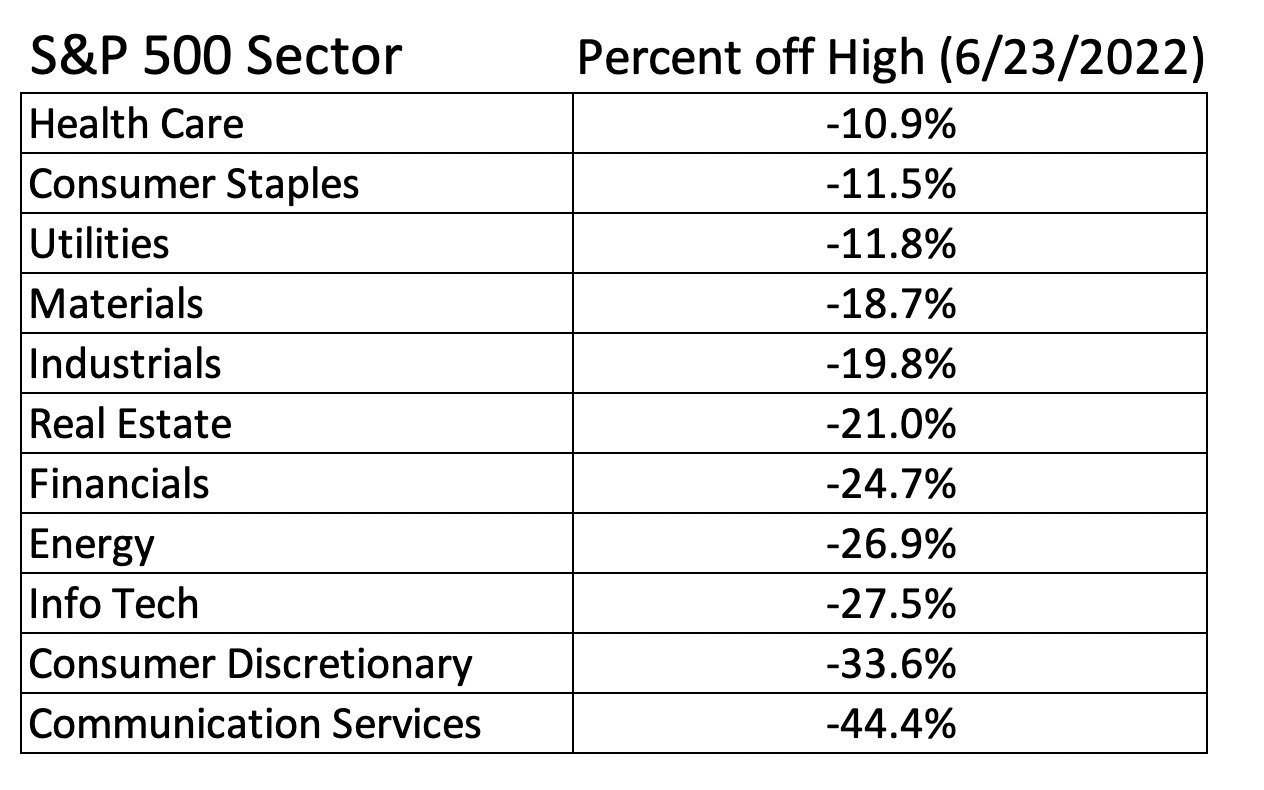

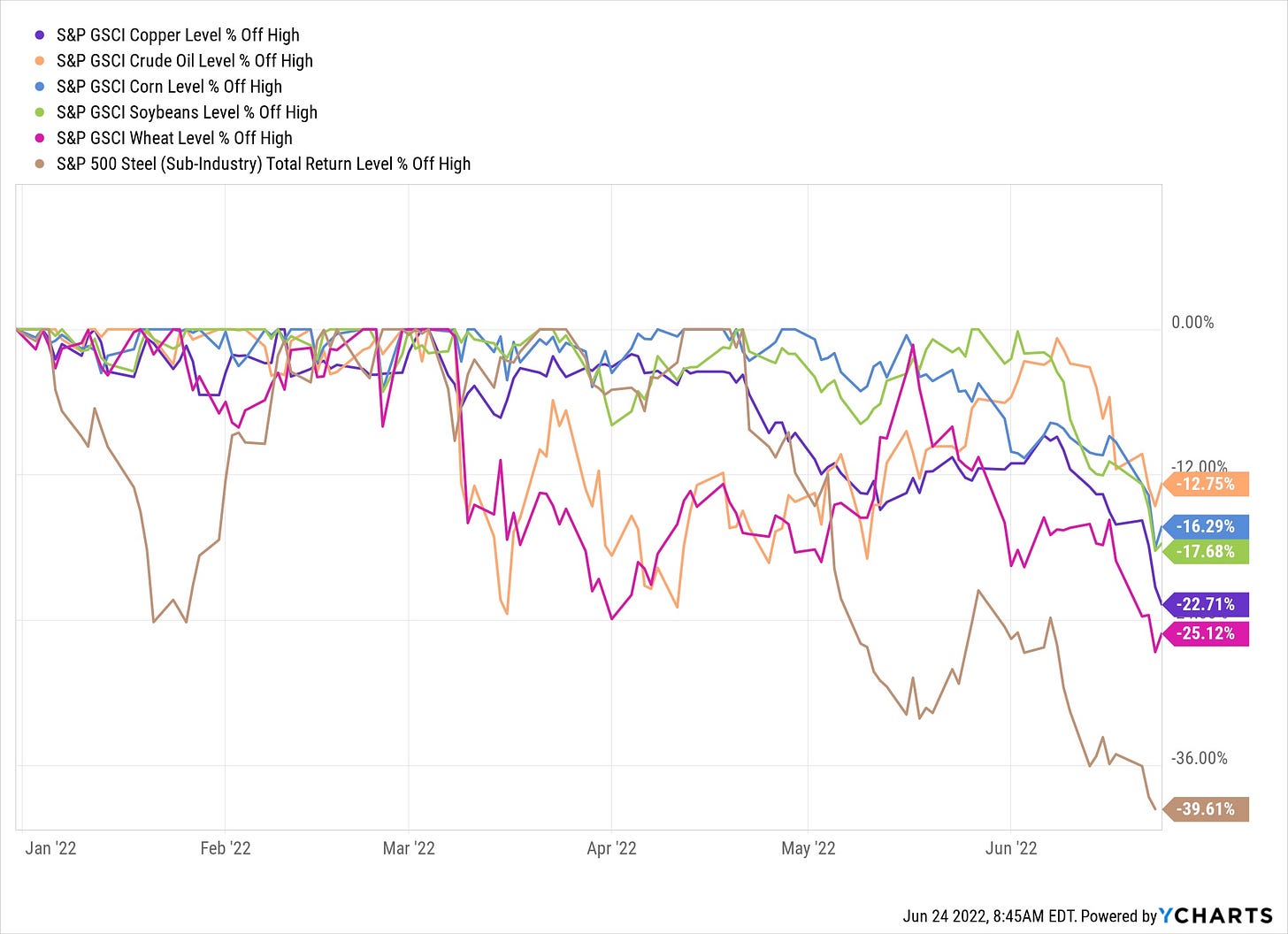

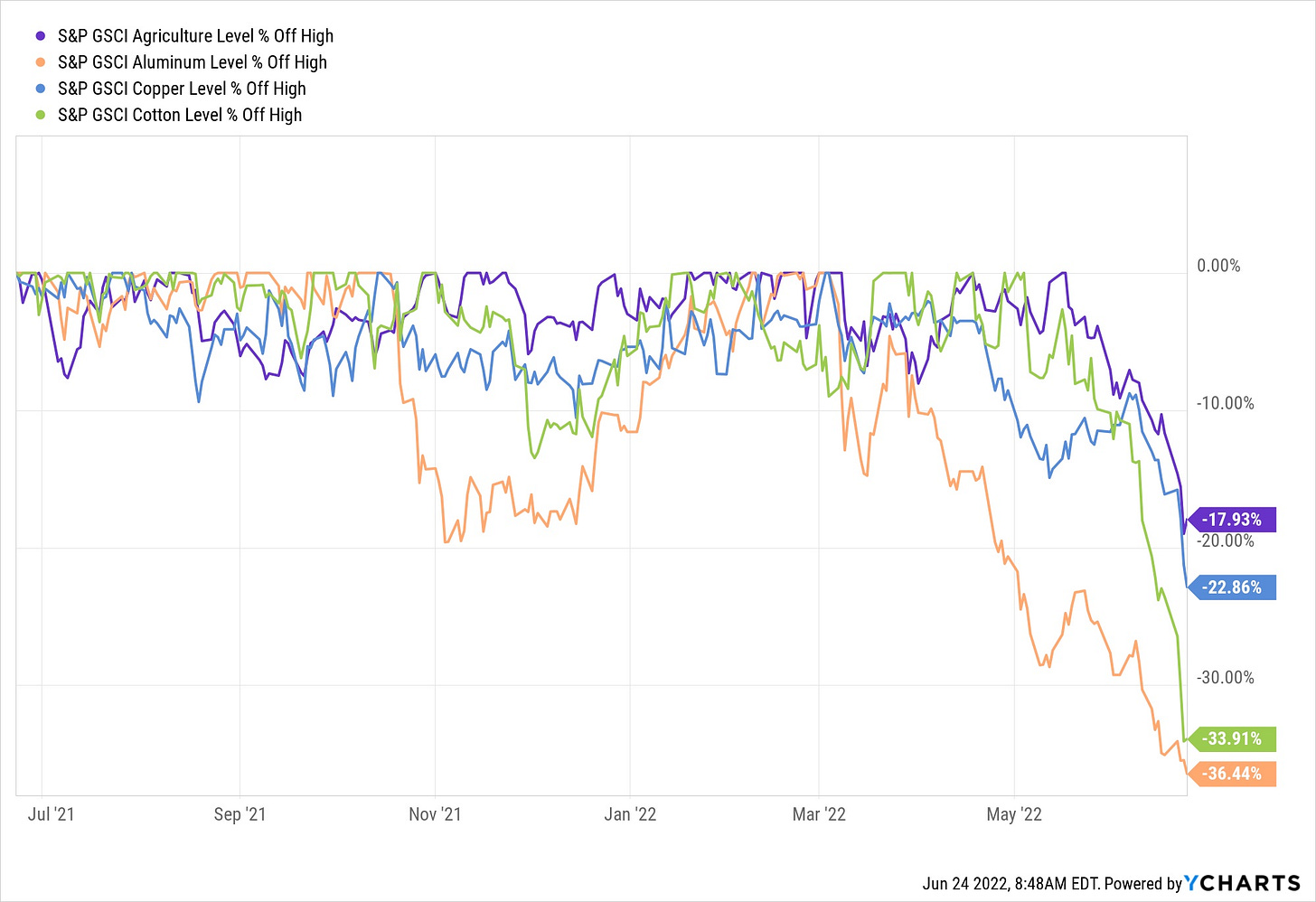

If we are talking about inflation indicating rising prices because demand is outpacing supply, then it is tough to support that narrative across the economy when we see so many in correction if not full-on bear market territory. Here are just a few. When materials and energy are falling this hard, inflation is in the rearview mirror.

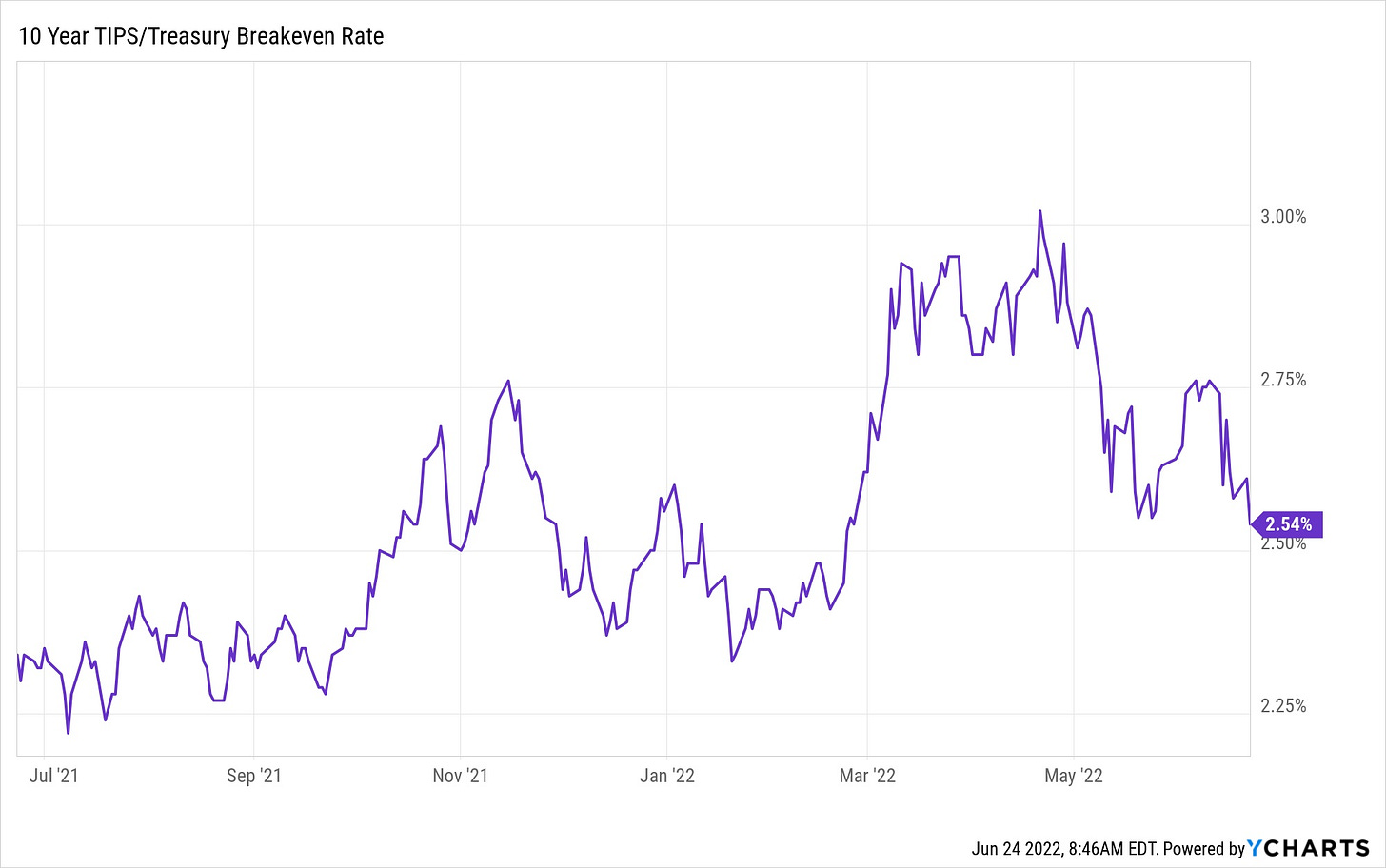

The bond market is also letting us know that growth is at risk. The 10-year TIPS breakeven has fallen nearly 50 basis points from the peak. Mr Bond Market isn’t going for the inflation fears.

Finally, when Transports are kicking the butt of Utilities this hard, you know it is all about being defensive.

With that, I’ll wish you a wonderful weekend from my terrace overlooking Lake Como, Italy where we are FINALLY getting some much-needed rain. Much of Europe has been suffering through a record heatwave and Italy is facing a severe drought - just awesome in the face of an energy crisis and a global food shortage.

On a more pleasant note, I cannot express the joy I’ve been experiencing seeing the astounding number of tourists here after having had hardly any since the start of the pandemic. I used to grumble mightily during the season, now I cheer seeing them, especially the Americans. I’ve been told by locals that they spend the most and are the nicest - wonderful to the ears of an Irish-American lass (e adesso quasi italiana).