Earlier this week I spoke with Julie Hyman (@JulesHyman) and Brad Smith (@TheBradSmith) on Yahoo Finance about the state of the markets and the economy. If you feel so inclined, here is a link to the interview.

I talked about how the markets have been utterly brutal. The S&P 500 has declined 9 of the past 10 weeks. In the post-WWII period, this has only happened 3 other times - 1970, 1982, and 2001. Every one of those was around a recession.

Portfolios are getting hammered. We are currently in the largest nominal drawdown for the combined bond and stock market on record.

But wait, there’s more! The state of the consumer has deteriorated faster than we have seen in decades and both consumers and small biz are telling us the recession is already here.

Mortgage rates have increased at the fastest pace in history.

Last week’s Michigan consumer sentiment report blew away all the lows of the past 11 recessions, even the post-9/11 era, the Great Financial Crisis, and the pandemic.

The misery is widespread across generations, income levels, and geography – that says a lot.

The 12-month “business expectation” metric has plunged from 62 in April, to 46 in May, to 35 in June — the weakest since the depths of the recession in February 2009.

The share saying they expect the economy to get worse in the next year hit the highest level since April 1980, rising from 39% to 44%.

Despite the official unemployment rate sitting at 3.6%, the mean share expecting higher incomes dropped to the lowest level since the peak anxiety recession level in April 2020. But back then, the Fed was moving to kickstart the economy and the federal government was set to unleash a tsunami of stimulus checks. Today, all that is moving in reverse.

The index assessing government policy is down to a nine-year low of 57. Not great news for incumbents up for reelection.

The measure of those expecting a "comfortable retirement" sank to a nine-year low.

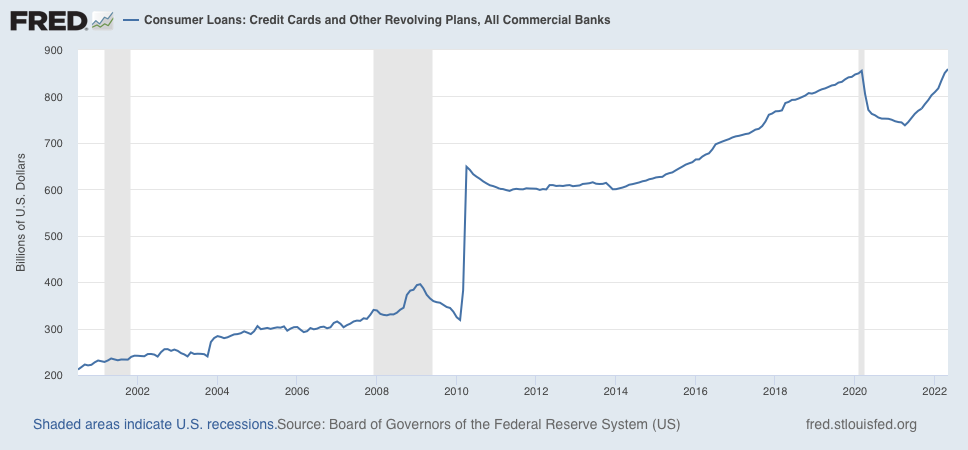

Soaring credit card debt (last time it was this high was just before 2008 Financial crisis)

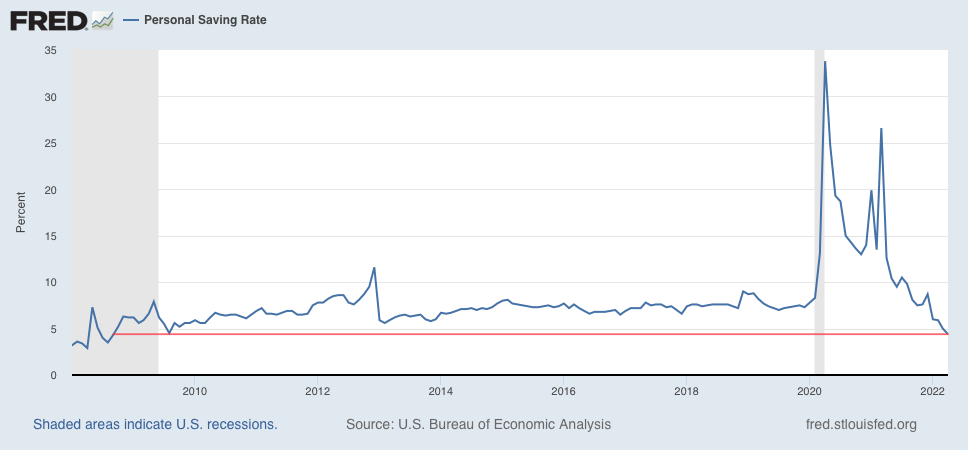

Collapsing savings rate (now at lowest level since 2008 Financial Crisis)

The Great Resignation theme is likely over and I expected to see more people coming off of the sidelines and rejoining the workforce, which will translate into a higher unemployment rate that will probably cause the Fed to pause – but most likely in the fall at the earliest.

It isn’t just the consumer – small business optimism dropped to the lowest level in the NFIB’s 48-year history, as measured by the percent expecting conditions to improve over the next 6 months.

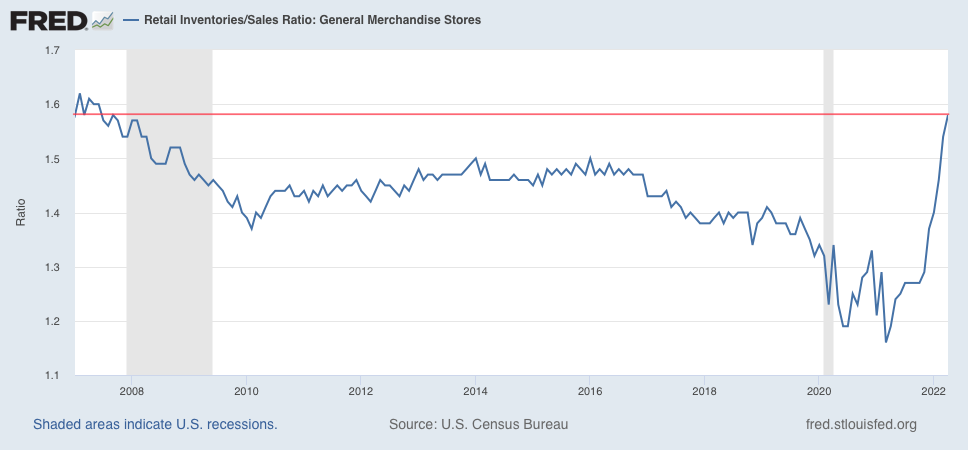

There are sky high inventory. General merchandise stores inventory to sales ratio is at a level not seen since just before the Great Financial crisis of the late 2000s which is profoundly deflationary. Retails will cut prices to move excess inventory.

The Retail Sales for May supports the Michigan Consumer Sentiment Survey’s dour outlook.

May came in weaker than expected and April revised downward, which is what we see when the economy is rolling over.

The key “core control” number that feeds directly into the consumer segment of GDP was flat compared to the expected increase of +0.3%.

Real retail sales weakest YTD in May, with a -1.2% decline & down now in 2 of the past 3 months & -0.6% annualized over the six months to May.

This translates into 0% growth for Q2 real retail sales growth, which has led to downward revisions to Q2 GDP estimates. Atlanta Fed Q2 GDP estimate is now at 0.0% following a contraction for GDP in Q1. Here’s the thing. If this wasn’t a recession, Q2 would have snapped back strongly. No rebound after a negative quarterly GDP print only happens in recessions.

What’s most concerning in the Retail Sales report is where consumers are spending. Together gas & grocery sales rose 21.6% YoY! Spending on these necessities means consumers have less to spend elsewhere.

Consumers are struggling and they know it.

Auto-buying intention index tumbled to a record-low of 37 from 46 in May.

The homebuying index, has dropped for seven months running and dropped to the weakest level since July 1982, one of the worst recessions in the past seven decades.

Last week the Fed increased rates by 75 basis points for the first time since the 1994 cycle. But back then, tightening started in the first 1/3rd of the economic cycle not in the last 20%, which is where we are today.

So what is an investor to do?

The good news is that the market moves far ahead of the economy. Remember the market bottomed in March 2009 but unemployment didn’t bottom until April 2010

How will we know the market is bottoming?

What we have not seen is a high-volume capitulation with VIX reading well above 40, which is typically how these things end.

Where is an investor to go?

Want to find an overcrowded trade? The share of respondents to the Michigan survey believing rates have more upside inched up to 88% from 87% to stand tied for the highest level on record. A mere 3% see the potential for them to come down in coming months.

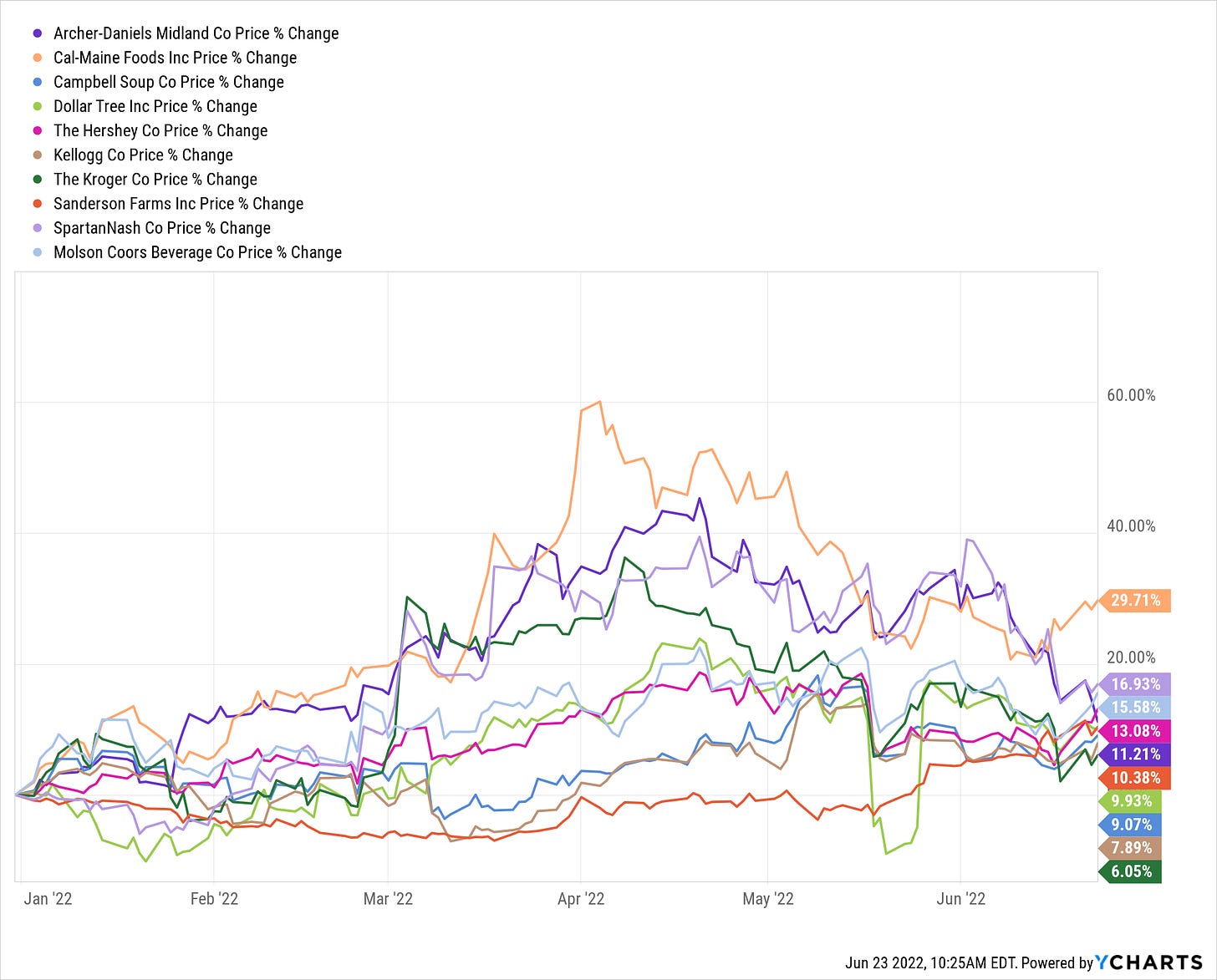

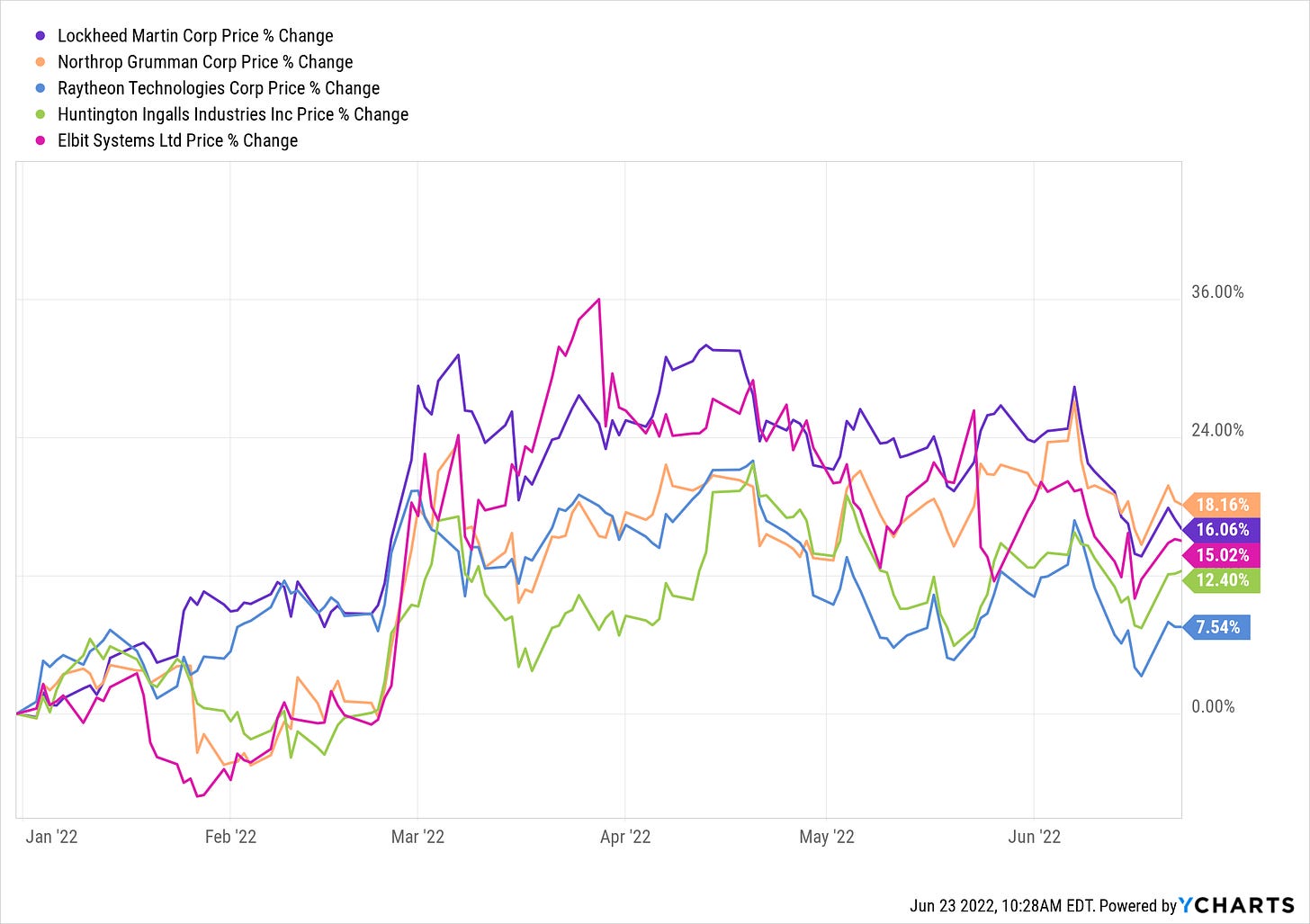

Outside of energy, there have been a few companies that have managed to eek out gains YTD, here are a few that stand out.

In general, the Consumer Defensive sector is a good place to look when the economy and the markets get wobbly.

Given what is going on in global politics and where governments are spending money more readily, Aerospace & Defense also looks pretty good.