If you feel like market volatility has been extreme lately, you aren’t wrong and it likely means that we are in for more pain. Yesterday’s worse-than-expected CPI report (more on that in another post out later today) got the market thinking that the Fed is likely to become even more hawkish, thus more likely to push the economy into a recession.

Yesterday the S&P 500 was up as much as 1.2% during morning trading only to close the session down 1.0%. Going back to 1993, there have only been 18 trading days where the S&P 500 ETF (SPY) was up at least 1% at the high and then down at least 1% at the close, with that close hitting a 52-week low (hat tip Bespoke Investment Group).

The Nasdaq saw a 480 point swing of -4.0% from the intraday high to the low.

The Dow saw a 750 point swing of -2.3%.

The 10-year Treasury yield experienced a -15 basis points swing from the high to the low and the 30-year a 17 basis point swing.

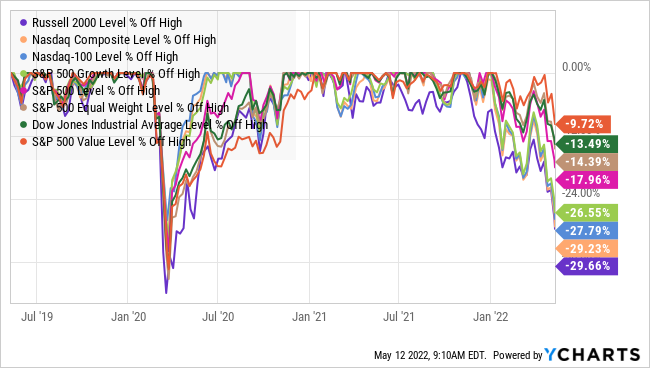

Weakness was focused (again) on the growth stocks with the S&P 500 growth index falling even more, to close 2.9% lower.

The Nasdaq Composite, Nasdaq 100, and Russell 2000 are all deep in bear market territory, well more than 20% off their highs.

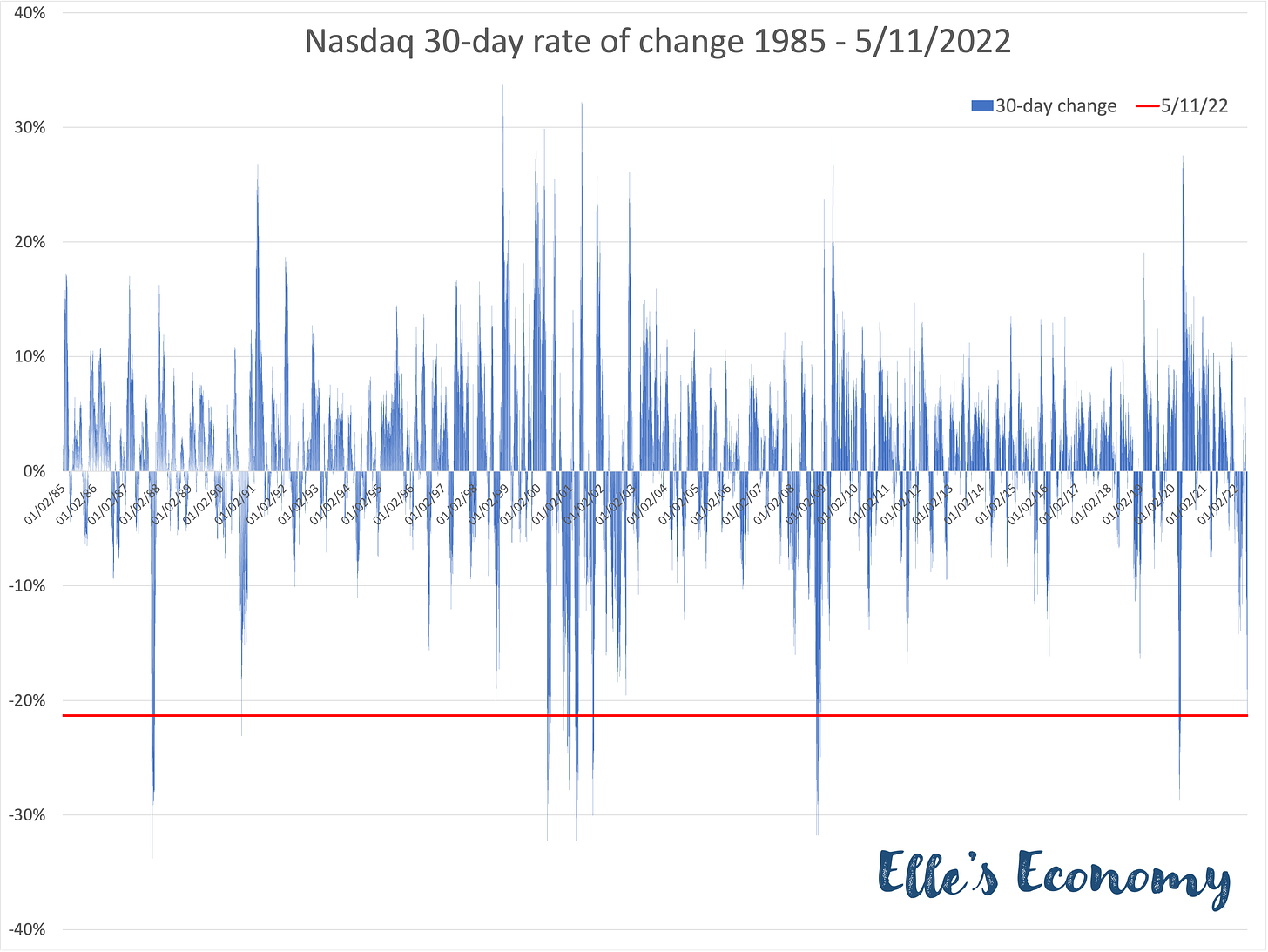

The Nasdaq Composite is now down 29.2% and has dropped 21.3% in the past 30 trading days alone. There are just 131 trading days going back to 1995 when the Nasdaq’s 30-day change was more negative than this, and all of them occurred during one of these five periods:

· October through November 1987 (27 days)

· August 1990 (2 days)

· August 1998 (1 day)

· March 2000 to October 2001 (65 days)

· October to November 2008 (23 days)

· March to April 2020 (13 days)

Five of those six occurred either during or within a one-year period of the start and/or end of a recession, with the only exception being the stock market crash of 1987.

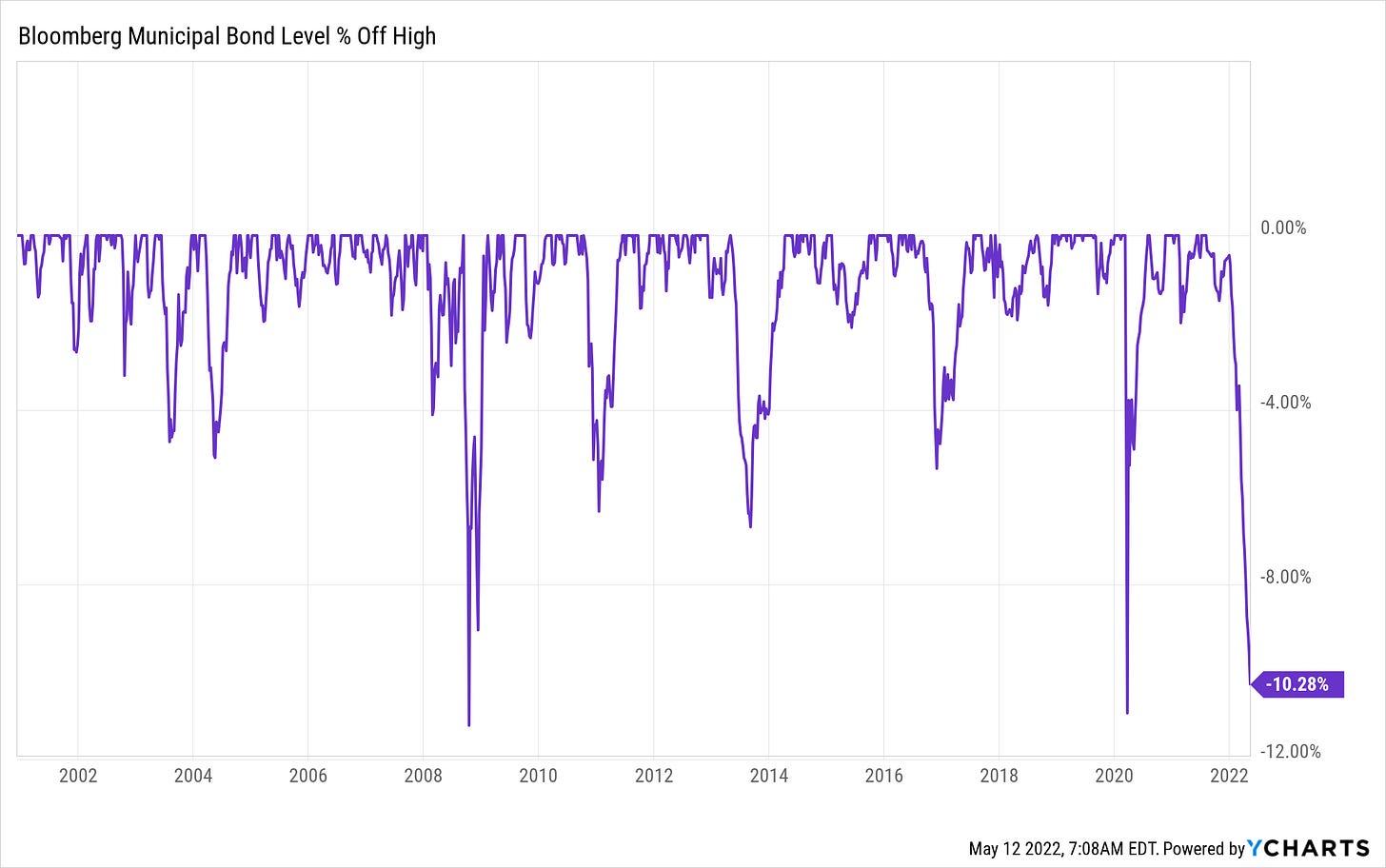

Equities aren’t the only ones feeling the pain. Municipal bonds are also getting hit hard.

The Bloomberg Municipal Bond Index, going back to 2001, has only seen two bigger drawdowns, one in April 2020 and the other in October 2008. The 1-year gains starting the following months for the indices were 13.6% and 7.4%, respectively.

The Treasury curve has flattened as front-end yields rise and long-end fall. The 10-year Treasury, for example, is down nearly 30 basis points from its nearby intraday high of 3.2%, so much for longer-term yields pushing higher and higher.

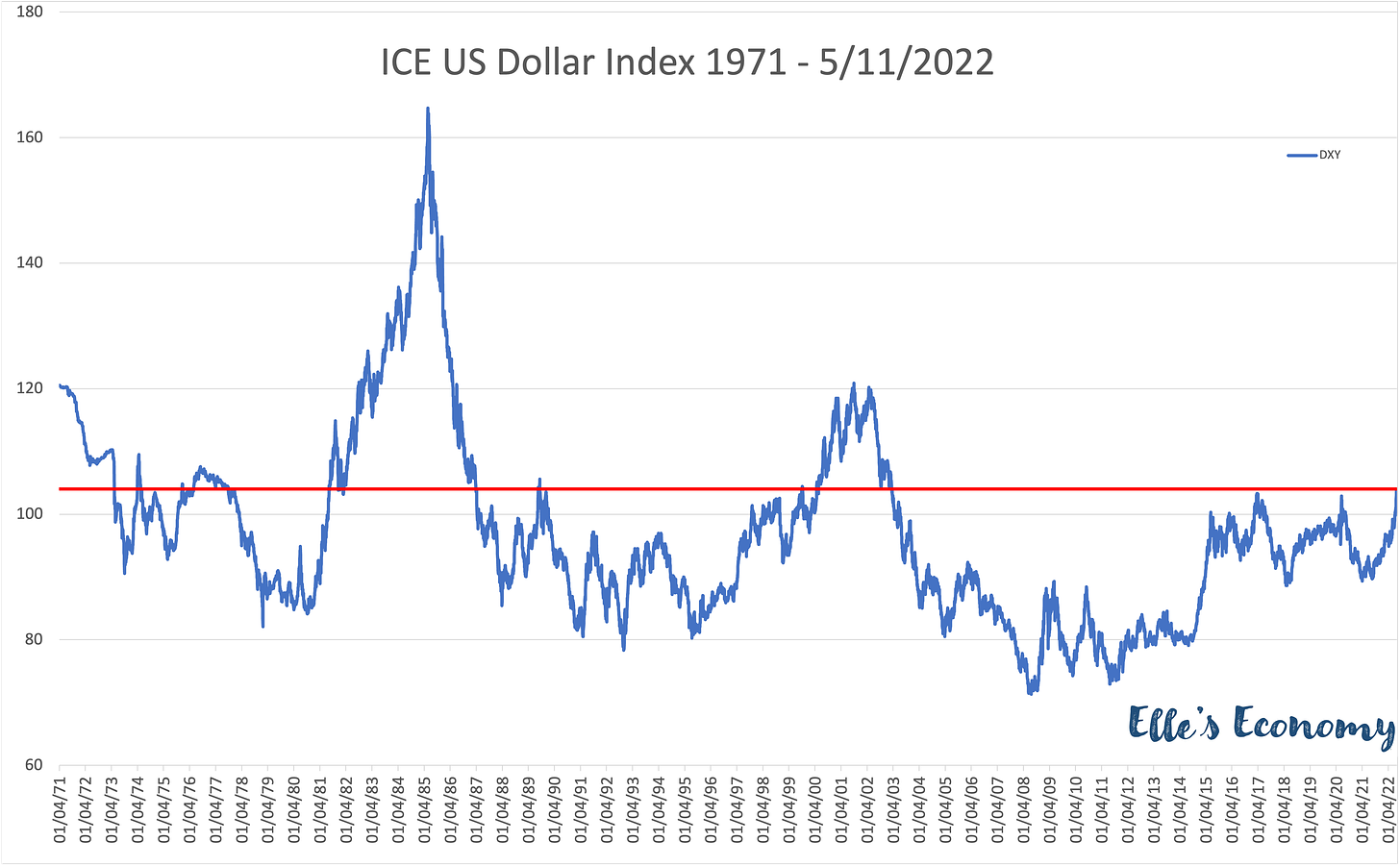

While crypto is getting crushed, the ICE US Dollar Index (DXY) is on a roll, spiking to over 104, reaching a level not seen in nearly twenty years. Having broken through major overhead resistance areas, the next stop is likely in the 107 range.

This is a serious squeeze on global liquidity. Think about all those countries and international companies that borrow in dollars but have revenue in some other currency. Every day that their revenue currency falls against the dollar, their debt becomes more expensive. This is also an enormous headwind to US exports (bad for US GDP) and the roughly 40% of S&P 500 revenue that is international. As the US dollar rises, revenue in non-USD declines on a US dollar basis.

The bottom line is that financial conditions have tightened to a level we last saw back in May 2020 but this time around things are very different. Today the Fed isn’t looking to open the spigot wider than ever before and the federal government isn’t looking to inject stimulus like there is no tomorrow. The situation today is the exact reverse with both fiscal and monetary policy serving as headwinds to GDP. Add onto that war in Ukraine that goes from optimism to frayed nerves on a weekly if not daily basis, and you’ve got cause for continued volatility and markets pricing in this new reality.

We aren’t out of the woods yet, but keep an eye on those companies that are managing the pain as investors that have cash ready will be able to buy at joyously discounted levels in the coming months.

PS - one of those companies that showed impressive skills this week is Sonos (SONO), which yesterday reported a 53% adjusted EPS beat on revenues that came in 14% above estimates despite, “ongoing, industry-wide supply constraints and rising cost pressures.” Got to love a company that delivers at a time when supply chains are challenged.

_____________________________

On a more personal note, I’ve been off of writing for a bit with travel to Ireland for a week and now I’m back in northern Italy where in 36 hours it went from spring, with the highs in the 60s to summer, with highs in the upper 80s! It is going to be a particularly hot one this year with energy costs so high that many, including government buildings, planning to use considerably less air conditioning.

I ran into these fellows on my morning run around Lake Como. They certainly know how to stay cool.

I have to say this is one of the hardest working mothers I have seen in a while.